Capital gains tax rate 2021 calculator

Schwab Charitable makes charitable giving simple efficient with a donor-advised fund. Long term capital gains tax rate in 2020 for 180000 15 capital gains tax capital gain x tax rate 4500 x 30000 15 short term capital gains example total employment income in.

Long Term Capital Gain Tax Calculator In Excel Financial Control

The inclusion rate refers to how much of your capital gains will be taxed by the CRA.

. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. For example if you bought art in January 2021 and sold it in January 2031 which. The long-term capital gains tax rate is usually 0 15 and 20 depending on your income and filing status.

Complete a Capital gains tax schedule 2022 CGT schedule if you. Are a company trust attribution managed. The same conditions apply in 2021 the higher your taxable income the higher will be the capital gains tax levied on it.

There are exclusions for this. Capital Gain Tax Amount 2002220k Average Tax Rate 1335 Adjusted Capital Gain Amount 100000100k Capital Loss Amount 00 This calculator is provided for. FAQ Blog Calculators Students Logbook Contact LOGIN.

Ad Calculate capital gains tax and compare investment scenarios with our tax tools. Enter your financial information below to calculate your Capital Gains. If you make a profit on your primary residence the chances are you wont have to pay capital gains taxes on that profit.

Proceeds of disposition Adjusted cost base Expenses on disposition Capital gains. Calculate the Capital Gains Tax due on the sale of your asset. For now the inclusion.

If your taxable income was 45000 and youre filing as a single person youd pay tax at a rate of 22 on that 2000 in gains for a total tax bill of 440 on your short-term gains. Add this to your taxable income. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

For 2022 and 2021 the long. Capital gains tax is calculated as follows. If you realize long-term capital gains from the sale of collectibles such as precious metals coins or art they are taxed at a maximum rate of 28.

Capital gains are taxed at the same rate as taxable income ie. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Access tax-forward insights tools strategies for maximizing after-tax return potential.

Ad Donate appreciated non-cash assets and give even more to charity. Business owners in the higher tax brackets for ordinary income should hang. If you earn 40000 325 tax bracket per.

The taxes in Canada are calculated based on two critical variables. Get Access to the Largest Online Library of Legal Forms for Any State. The amount of tax will depend on your.

Capital gains and losses are taxed differently from income like wages interest rents or royalties which are taxed at your federal income tax rate up to 37 for 2022. Because the combined amount of 20300 is less than 37700 the. Calculate the Capital Gains Tax due on the sale of your asset.

Capital gains tax rate 2021. Purchase Price Accelerated Depreciation Straight Line Depreciation Cost of Improvements Gross Sales. And since 50 of the value of any capital.

If you own the asset for longer than 12 months you will pay 50 of the capital gain. Ad The Leading Online Publisher of National and State-specific Legal Documents.

Tax Calculator Estimate Your Income Tax For 2022 Free

Itr Filing For Fy 2021 22 How To Calculate Capital Gain Tax On Sale Of Property Mint

Taxtips Ca 2021 And 2022 Investment Income Tax Calculator

Long Term Capital Gain Tax On Share And Mutual Fund Excel Calculation To Find Ltcg Of Mutual Fund Youtube

Uk Hmrc Capital Gains Tax Calculator Timetotrade

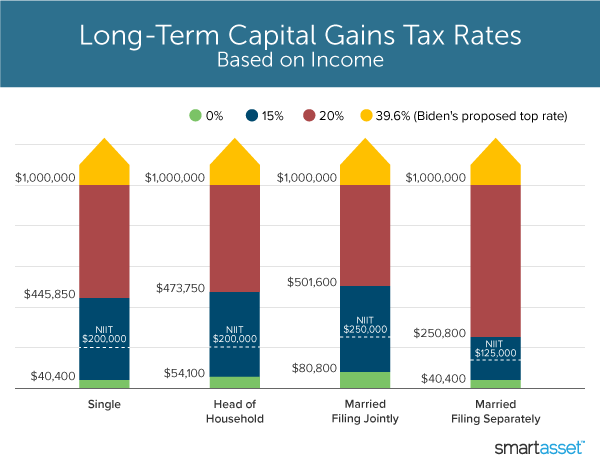

What S In Biden S Capital Gains Tax Plan Smartasset

2021 Capital Gains Tax Rates By State

Capital Gains Tax Calculator 2022 Casaplorer

Long Term Capital Gains Tax What It Is How To Calculate Seeking Alpha

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista

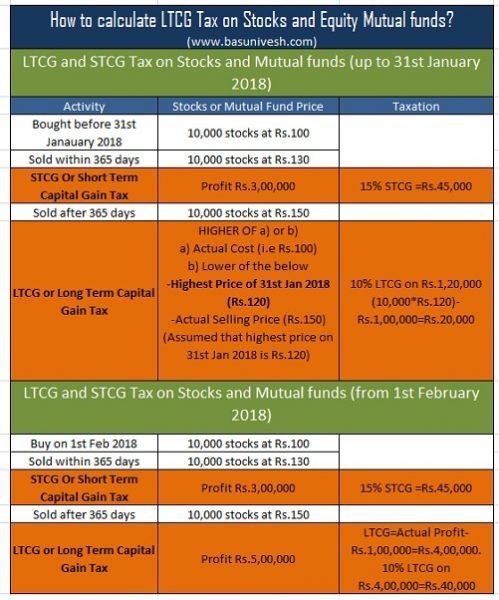

Mutual Fund Taxation Fy 2021 22 Ay 2022 23 Capital Gain Tax Rates Basunivesh

Mutual Fund Taxation Fy 2021 22 Ay 2022 23 Capital Gain Tax Rates Basunivesh

Long Term Capital Gain Tax Calculator In Excel Financial Control

How Are Dividends Taxed Overview 2021 Tax Rates Examples

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

3 Ways To Calculate Capital Gains Wikihow